Articles

08.07.2024

How Credit Scores Affect Car Loans and Exploring Financing Options for Bad Credit

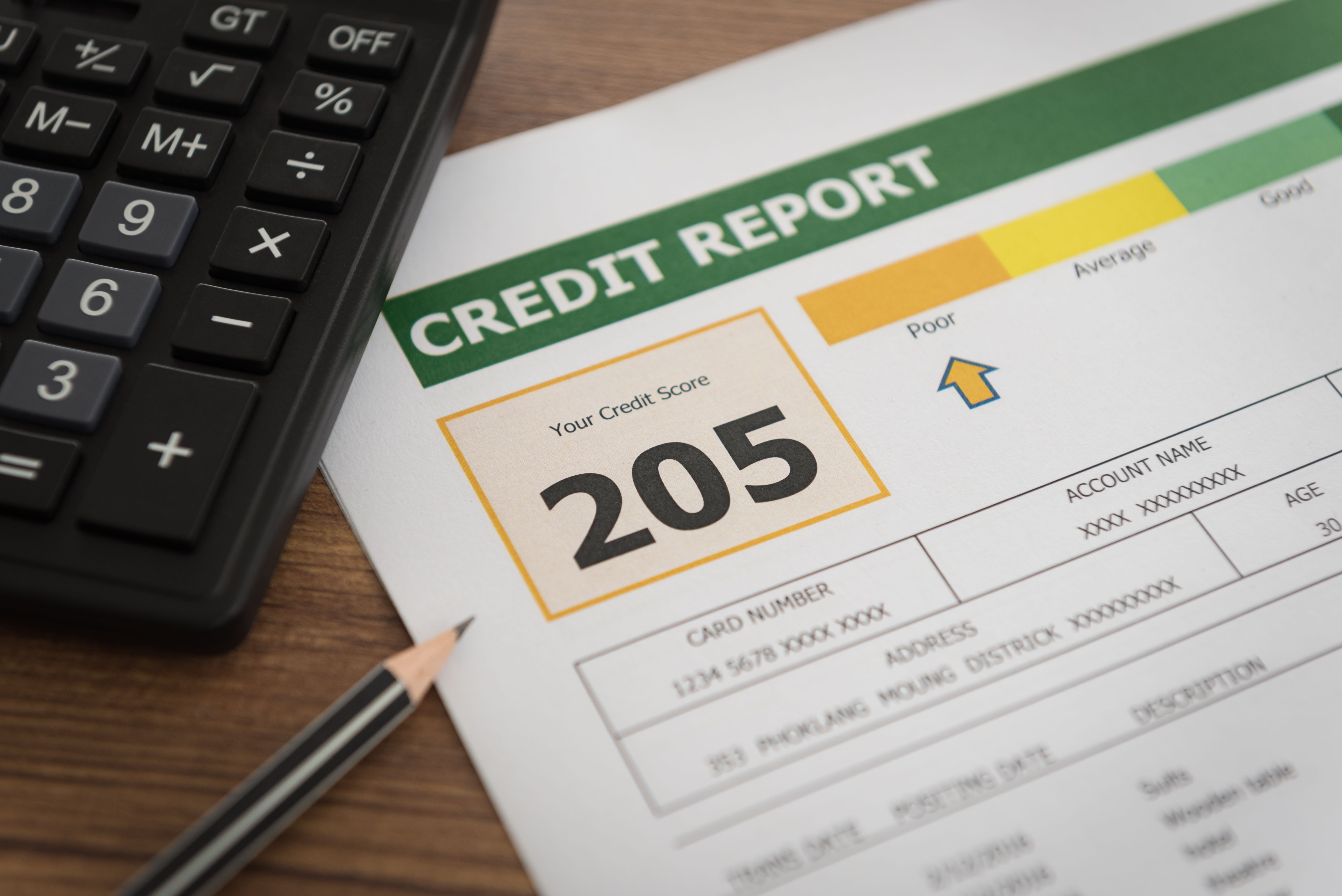

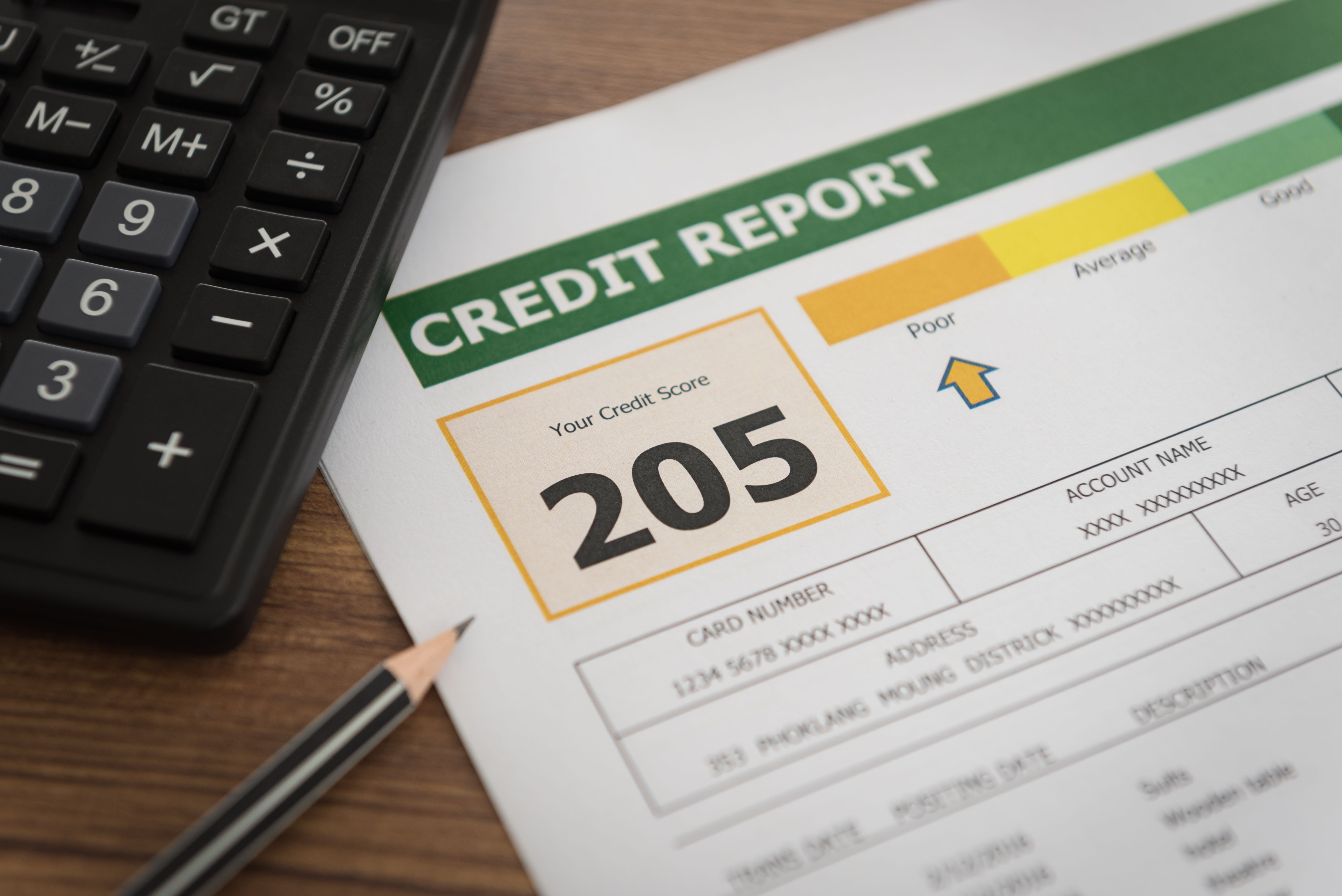

Credit scores are a reflection of your creditworthiness, and lenders use them to assess the risk of lending money. Typically, credit scores are categorized as follows:

For individuals with low credit scores, obtaining a car loan can be difficult, but it is not impossible. There are several alternative financing options available that can help you get behind the wheel despite having bad credit.

Alternative Financing Options for Bad Credit

Flexible Car Financing Solutions

One effective solution for those with bad credit is using platforms that connect used independent car dealerships with lenders. For example, Automatic understands the challenges faced by individuals with bad credit and provides a platform that ensures a range of financing options tailored to meet diverse needs. By working with lenders willing to engage with consumers across the credit spectrum, Automatic ensures that more people have the opportunity to purchase a vehicle.

Through Automatic, dealerships can access valuable financing solutions, allowing them to offer their customers more flexible loan options. This approach not only helps consumers secure financing but also supports dealerships in expanding their customer base and closing more sales. Automatic is committed to making the car-buying process easier and more accessible, providing a comprehensive solution that benefits both consumers and dealerships.

Access to Credit Rebuilding Programs

Additionally, certain platforms offer access to credit rebuilding programs, providing consumers with tools to clear their debt and improve their credit scores. This collaboration helps individuals with poor credit or large amounts of debt to enhance their financial health, further improving their ability to secure financing in the future.

Articles

How Credit Scores Affect Car Loans and Exploring Financing Options for Bad Credit

08.07.2024

Credit scores are a reflection of your creditworthiness, and lenders use them to assess the risk of lending money. Typically, credit scores are categorized as follows:

For individuals with low credit scores, obtaining a car loan can be difficult, but it is not impossible. There are several alternative financing options available that can help you get behind the wheel despite having bad credit.

Alternative Financing Options for Bad Credit

Flexible Car Financing Solutions

One effective solution for those with bad credit is using platforms that connect used independent car dealerships with lenders. For example, Automatic understands the challenges faced by individuals with bad credit and provides a platform that ensures a range of financing options tailored to meet diverse needs. By working with lenders willing to engage with consumers across the credit spectrum, Automatic ensures that more people have the opportunity to purchase a vehicle.

Through Automatic, dealerships can access valuable financing solutions, allowing them to offer their customers more flexible loan options. This approach not only helps consumers secure financing but also supports dealerships in expanding their customer base and closing more sales. Automatic is committed to making the car-buying process easier and more accessible, providing a comprehensive solution that benefits both consumers and dealerships.

Access to Credit Rebuilding Programs

Additionally, certain platforms offer access to credit rebuilding programs, providing consumers with tools to clear their debt and improve their credit scores. This collaboration helps individuals with poor credit or large amounts of debt to enhance their financial health, further improving their ability to secure financing in the future.